n The typical rate of interest for month-to-month loans can vary significantly depending on components such because the borrower's credit score, the type of mortgage, and the lender's insurance.

n The typical rate of interest for month-to-month loans can vary significantly depending on components such because the borrower's credit score, the type of mortgage, and the lender's insurance policies. Generally, personal loans may range from 5% to 36% APR, while secured loans, like car loans, might have decrease charges because of the reduced danger for lenders. It is advisable to shop around and examine provides to search out essentially the most aggressive fee for your specific state of affa

Additionally, seeking loans from respected lenders considerably reduces the danger of falls into predatory lending traps characterised by misleading phrases and exorbitant fees. Researching potential lenders, studying buyer evaluations, and completely comparing presents can equip debtors with the data necessary to make educated selecti

In at present's fast-paced world, financial emergencies can come up at any time, requiring instant solutions. Same-day loans have emerged as an important resource for people needing fast cash to cowl sudden bills. These loans provide a fast and convenient way to access funds, avoiding prolonged traditional mortgage processes. This article delves into the dynamics of same-day loans, their benefits, pitfalls, and the way people can responsibly utilize these monetary products, whereas additionally introducing BePick, a useful resource for detailed info and evaluations about same-day lo

Additionally, it’s essential to keep in mind that a business mortgage is an funding in growth. Use the funds correctly to foster innovation, whether by investing in new technology, expanding market attain, or enhancing service supply, thus making a positive feedback loop for future succ

Furthermore, using a loan to spend money on development alternatives typically yields greater returns than the value of borrowing. For occasion, equipping your small business with the most recent know-how would possibly improve efficiency and customer satisfaction, translating into higher income that may overshadow mortgage repayme

Alternative lenders, however, could present faster entry to capital with more versatile requirements. Options like peer-to-peer lending or crowdfunding present unique opportunities for startups and small businesses. However, these can come with greater rates of interest, necessitating careful evaluation of phrases and circumstan

Types of Debt Consolidation Loans

Debt consolidation loans come in numerous varieties, every with its own execs and cons. Personal loans are the commonest type, which can be secured or unsecured. Secured loans require collateral, usually resulting in lower interest rates however greater risks for the borro

While securing a business loan with poor credit score is difficult, it’s not inconceivable. Alternative lenders, similar to peer-to-peer platforms or microlenders, may provide options with more lenient criteria, typically at greater interest rates. Exploring all avenues is import

Small loans have turn into more and more in style as people and businesses search fast access to funds with minimal documentation. The flexibility and convenience of those loans cater to quite a lot of monetary needs, from personal expenses to sudden bills. However, navigating the world of small loans could be overwhelming with out the proper data. This is the place platforms like 베픽 come into play, offering comprehensive insights and evaluations about small loans to empower debtors in making informed choi

Moreover, BePick additionally engages in person critiques that can guide potential debtors in choosing the right mortgage products that align with their monetary situations. Exploring such sources allows borrowers to make knowledgeable selections and minimize the risk of delinquency sooner or la

Final Thoughts on Same-Day Loans

Same-day loans can provide important financial assist throughout emergencies, granting quick entry to cash when needed most. However, like all monetary product, they require cautious consideration and responsible administration. By utilizing sources corresponding to BePick for steering

Loan for Bankruptcy or Insolvency, debtors can navigate the complexities of same-day loans, guaranteeing they make informed decisions that align with both their instant needs and long-term monetary hea

Selecting the right enterprise mortgage requires a deep understanding of your corporation's specific needs and financial health. Start by assessing the amount of funding required and the purpose of the mortgage. This will assist narrow down the choices and give attention to solutions that best meet those necessit

Interest rates for same-day loans can vary broadly based on many factors, together with lender insurance policies, borrower credit score rating, and

24-Hour Loan quantity. Typically, these loans may function rates ranging from 10% to 35% or higher. It's essential for borrowers to carefully evaluate rates and perceive the total value of the loan earlier than committ

Escort Service in Ajmer 100s Of Escorts & Call Girls

De nlm7976kumar

Escort Service in Ajmer 100s Of Escorts & Call Girls

De nlm7976kumar Dr. Kevin Molldrem’s Approach to Aging Gracefully: Health Strategies for Longevity and Vitality

Dr. Kevin Molldrem’s Approach to Aging Gracefully: Health Strategies for Longevity and Vitality

Independent Ajmer Escort And Call Girls Near By LN Courtyard Hotel

De nlm7976kumar 50% Off On Booking of udaipur escorts services with Cash Payment facility

De neel1998

50% Off On Booking of udaipur escorts services with Cash Payment facility

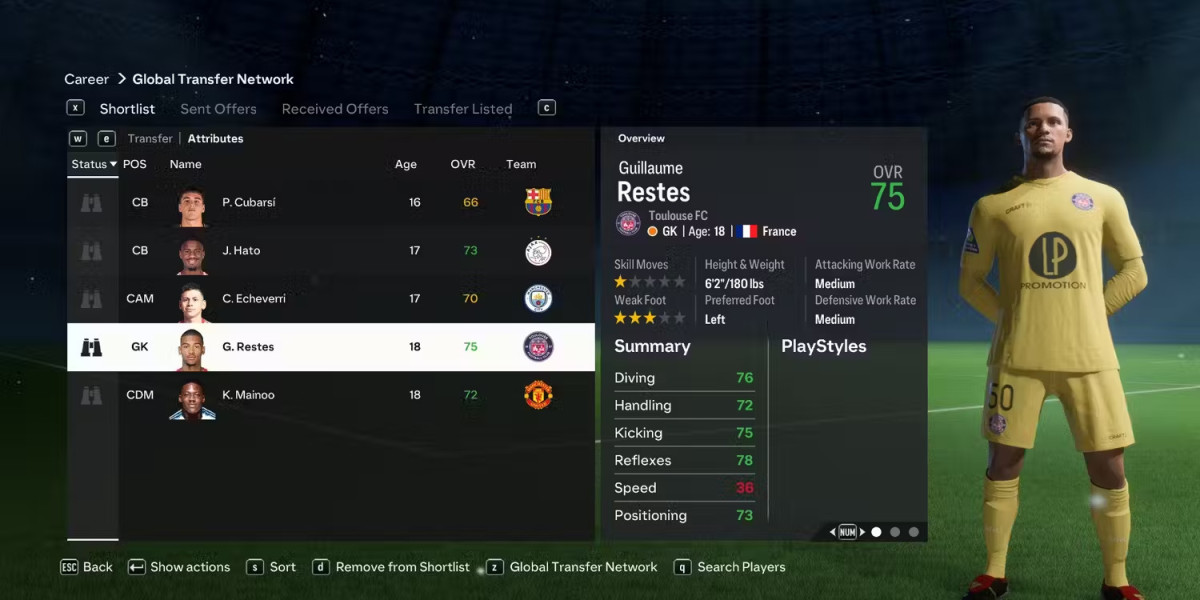

De neel1998 Miglior Squadra Iniziale per EA FC 25 con Meno di 10.000 Crediti

De Ethann

Miglior Squadra Iniziale per EA FC 25 con Meno di 10.000 Crediti

De Ethann